BBPS

BBPS

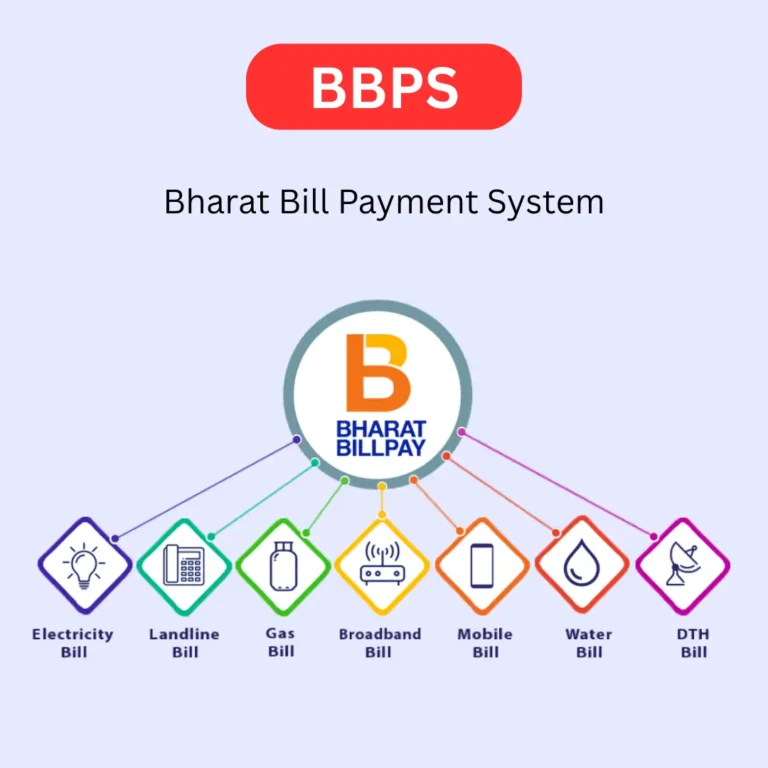

BBPS (Bharat Bill Payment System) is a robust, centralized system designed to simplify and standardize bill payments across India. It was introduced by the Reserve Bank of India (RBI) and is managed by the National Payments Corporation of India (NPCI). BBPS offers a unified platform that enables consumers to pay utility bills, insurance premiums, taxes, loan payments, and other services in a seamless, quick, and secure manner.

Key Features of BBPS

Centralized Bill Payment Platform

Provides a single platform for users to pay all types of bills, including utilities, insurance premiums, loan repayments, and more.

Multiple Payment Channels

Payments can be made through mobile apps, websites, ATMs, bank branches, and physical agents.

Instant Payment Confirmation

Real-time payment processing and instant payment acknowledgment.

Wide Range of Billers

Integrates with a large number of billers across various industries such as electricity, water, gas, telecom, and more.

Payment History

Users can access detailed transaction history for better tracking and record-keeping.

Secure Transactions

Payments are processed through secure, encrypted channels to protect users’ personal and financial information.

Accessibility Across India

BBPS is available across urban and rural areas, making it highly accessible to people from all regions.

Prepaid and Postpaid Bill Payments

Supports both prepaid and postpaid services, allowing users to pay in advance or settle monthly charges.

No Hidden Charges

Transparent pricing with no hidden fees for users.

Benefits of BBPS

Convenience

BBPS allows users to pay all their bills in one place, eliminating the need to visit multiple service provider offices or websites.

Time-Saving

Automated payment processing saves users time as they don’t have to manually initiate each payment.

Timely Payments

With the option of setting up automatic payments, users can ensure their bills are paid on time, avoiding late fees and penalties.

Increased Security

Using a centralized, secure platform for transactions ensures users’ financial information is kept safe.

Round-the-Clock Availability

BBPS allows users to pay their bills 24/7 from anywhere, using mobile or web-based platforms.

Efficient Bill Management

It consolidates various types of payments, making it easier to manage recurring payments and avoid missing deadlines.

Reduced Payment Disputes

Instant payment confirmations reduce the likelihood of payment-related disputes and offer a clear record for both consumers and service providers.